Restaurant traces have continued to blur as gross sales bounce again and a brand new panorama settles. Principally, this has darted by two locations: Expertise and accessibility, which has introduced the working fashions of quick meals and quick informal nearer collectively. Drive-thrus and pickup lanes are actually on the actual property calendars of each.

The times of quick casuals sparking improvement by inline builds has progressed into one thing pliable. As has the notion upscale chains solely circle city markets. Manufacturers like Shake Shack, Starbucks, and Sweetgreen, in addition to Chipotle, have developed towards suburban locales to accommodate those self same new builds, which serve at present as omnichannel hubs as a lot as anything, from devoted curbside spots to the flexibility to ship alternative past what prospects order off the menu; it’s turn out to be a race to current a number of ordering choices.

And all of this has additionally touched full service and informal eating particularly. Smokey Bones, Texas Roadhouse, Applebee’s, and others are constructing or tacking on home windows (a full drive-thru in Smoke Bones’ case) to streamline off-premises.

However previous the designs themselves, you could possibly additionally credit score cell ordering for accelerating this actuality. It’s made it more and more tough for manufacturers to distinguish on an open market. As Intouch Perception explains in its newest Cellular Ordering Tendencies Report, when customers are utilizing the identical system or utility to order put together meals, the shopper expertise is tough to separate.

Cellular functions are solely gaining steam. Seventy-one p.c of customers within the report, based mostly on two units of information—surveys of greater than 1,000 responses and thriller consumers finishing 500 purchases—reported utilizing a cell app to purchase meals from a restaurant.

The pattern line for C-stores has shifted, too. There was a 47 p.c spike, even with comparatively low utilization, of other buying strategies (like cell ordering) to finish a purchase order from a C-store in the summertime of 2022.

Intouch Perception famous this was noteworthy given ready meals and groceries have been the highest two extra bought gadgets from C-stores utilizing various strategies. So cell functions, in idea, have the potential to turn out to be one of many ready meals world’s hottest battlegrounds headed into 2023.

What gadgets did you buy through cell app from a C-store?

- Ready meals: 24 p.c

- Groceries: 24 p.c

- Snacks: 17 p.c

- Sport/tender drinks: 16 p.c

- Espresso: 11 p.c

The most important development in last-mile companies from C-stores got here from these putting orders for supply, particularly through third-party. This could alert quick-serves, Intouch Insights stated, since aggregators are providing ready meals from C-stores and eating places side-by-side.

How did you full your supply order from a C-store?

First-party app

- Fall 2021: 19 p.c

- Summer season 2022: 37 p.c

Third-party app

- Fall 2021: 19 p.c

- Summer season 2022: 47 p.c

The C-store dialog has ebbed and flowed through the years, when it comes to whether or not they’re threatening quick-service eating places’ market share head on or not. However that subject has jumped of late. Given fuel costs, ecommerce choices like Amazon for home goods, and, to Intouch Perception’s level, how third-party aggregators have redefined comfort, C-stores have been compelled to rethink why individuals present up. Gasoline isn’t the one beacon. Manufacturers like Buc-ees and Wawa are drawing site visitors for merchandise. And chains equivalent to 7-Eleven are creating proprietary restaurant ideas (Increase the Roost Hen and Biscuit, for one) in its Evolution design. After which there’s the know-how and potential drive-thru points of the place this class may evolve. An earlier report from Bluedot discovered 61 p.c of customers would go to a C-store extra typically if cell ordering, drive-thru, and curbside pickup have been obtainable.

Fifty-nine p.c famous they’d think about buying a meal from a C-store when stopping for quick meals. One in 4 respondents added they go to C-stores for lunch. Of that, 29 p.c accomplish that for quick meals (manufacturers inside the placement or proprietary setups, like 7-Eleven); 27 p.c eat grab-and-go refrigerated gadgets; 25 p.c scorching meals (like pizza or scorching canines, and many others.); and 21 p.c made-to-order meals. Additionally, 51 p.c drop in for snacks; 20 p.c for grocery gadgets; and 16 p.c for alcoholic drinks.

Basically, Bluedot’s knowledge painted an image of a keen C-store shopper able to interchange events with quick meals. However, with the caveat the latter closes the comfort hole that has lengthy separated them—particularly the drive-thru; the very fact quick meals is usually a direct daypart go to and C-stores a complementary event that accompanies filling up on fuel.

What Intouch Perception suggests is that narrowing is already happening due to the third-party market.

A celebration debate

The primary versus third-party dialogue is hardly contemporary to 2022. Aggregators problem manufacturers’ skill to regulate buyer journeys and predict future ones. But the attain alone sometimes outweighs the priority. Generally, there’s no actual alternative as effectively for manufacturers who can’t white-label networks at scale, or compete with the hyper-marketing third-party firms are recognized for.

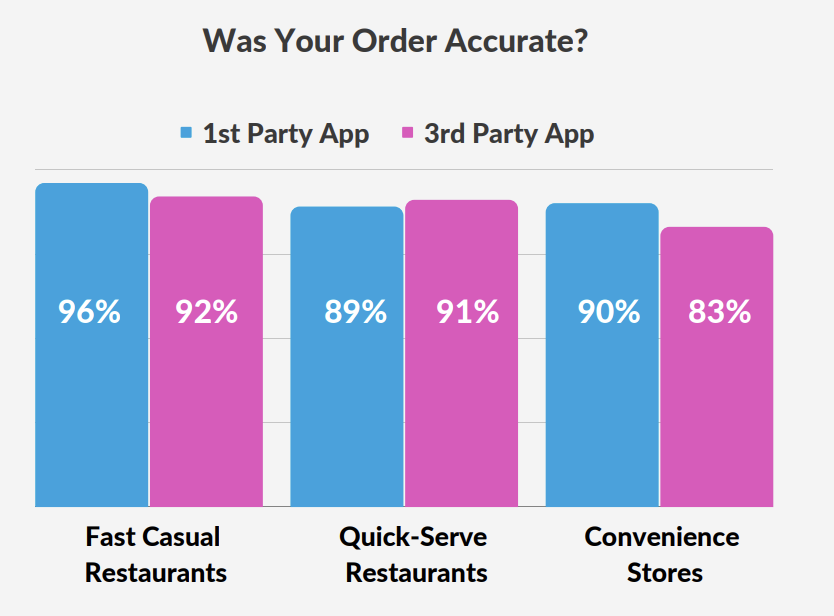

Intouch Perception measured the expertise supplied by each throughout manufacturers that supply ready meals, utilizing a thriller buying program to guage real-time efficiency. Whereas the information confirmed first-party apps usually scored increased throughout lead metrics, eating places might want to do extra to outperform aggregators so as to guarantee they drive customers towards their very own channels, the corporate stated.

Intouch Perception used internet promoter scores to take inventory (how possible customers have been to advocate to others). As a part of the thriller buying research, consumers have been requested to fee their probability to advocate the model’s first-party apps or third-party supply service.

Quick informal pulsed within the knowledge. There, prospects have been much more prone to advocate first-party choices in comparison with third-party companies.

Intouch Perception additionally checked out buyer satisfaction scores (CSAT), which values company’ total satisfaction with a product or companies. Once more, the largest hole flashed in quick informal.

When it got here to the main motive customers selected a cell app, although, the idea was a uniform one: comfort. And that is the place third-party platforms have traditionally edged forward. The flexibility to supply selection alongside comfort is tough to rival. It’s why first-party apps, Intouch Insights stated, must win throughout different metrics (one level being worth and repeatedly communicated, and customized, incentives).

What components affect your selections to make use of a cell app for a ready meals buy?

- Comfort: 68 p.c

- Prefers to eat at dwelling: 42 p.c

- Quicker than eating in: 17 p.c

- Capability to trace order progress: 13 p.c

- Fewer interactions with staff: 8 p.c

“We discovered that comfort is the primary issue that drives customers to make use of a cell app to order meals. Manufacturers who need to delight prospects with cell ordering and draw site visitors from third-party functions should focus their efforts on enhancing key parts of the consumer expertise, making it as straightforward as doable for customers to order on-line immediately from their very own channels,” says Laura Livers, head of strategic development at Intouch Perception.

Into the differentiators

If manufacturers need to switch third-party loyalists into first-party regulars, it begins with expertise. In accordance with Intouch Insights’ report, the 2 most vital parts proved to be order accuracy and pace of service. First- and third-party apps carried out carefully, however white label outperformed normally. “Nonetheless, it is essential to recollect the rise of latest shopper issues,” the corporate stated. “Even with out social distancing necessities, most prospects nonetheless really feel safer avoiding in-person interactions and third-party apps are main the best way regards to contactless service.”

How do you anticipate your use of cell ordering to alter within the coming months?

- Enhance: 6 p.c

- Keep the identical: 61 p.c

- Lower: 33 p.c

- Contemplating the above outcomes, cell ordering isn’t going anyplace.

Rating varied points of their ordering expertise from most to least essential, order accuracy was far and away the highest issue, with 86 p.c of respondents itemizing it as the primary or second most crucial ingredient, adopted by the temperature of the meals and the pace of supply. Naturally, these remaining two are joined on the hip.

On common, one in 10 orders have been inaccurate throughout all apps and segments through Intouch Perception’s thriller buying knowledge. In-house fast-food channels got here in beneath third-party.

“Manufacturers have full management when setting buyer expectations round pace of service with first-party apps—making it an space they’ll actually differentiate themselves,” Intouch Insights stated.

Nonetheless, regardless of outperforming third-party apps, prospects have been nonetheless receiving orders positioned by first-party late 13–19 p.c of the time. So there’s development to chase.

To the sooner level on social distancing, there stay loads of prospects who admire the nameless nature of cell ordering. It’s a behavior that’s been added to their event set. Someday a visitor would possibly need to go inside and discuss to any person; one other they may need to eat of their automobile with the radio on. The distinction, broadly, is now they’ve choice.

Do you’re feeling safer utilizing a cell app than ordering at a counter in-person?

- No: 23 p.c

- Sure: 77 p.c

Do you’re feeling safer having meals delivered than choosing up your order in-person?

- No: 27 p.c

- Sure: 73 p.c

However a lot of the hand-off stays contained in the restaurant.

The place did you decide up your order positioned through a first-part app?

- Inside/counter: 89 p.c

- Outdoors/curbside: 9 p.c

- Different: 2 p.c

“This discrepancy seems to be attributable to third-party apps providing contactless service much more persistently than first-party apps—marking a significant space for enchancment as manufacturers look to drive extra customers to their very own apps,” Intouch Insights stated.

Did the service provide contactless pickup/supply?

First-party app

- Sure: 67 p.c

- No: 33 p.c

Third-party app

- Sure: 96 p.c

- No: 4 p.c

In the long run, cell ordering has turn out to be a ubiquitous a part of the ordering journey. It seems the identical is occurring for white-label as manufacturers look to regain management.

“Whereas cell ordering isn’t new, it’s now desk stakes for these providing ready meals,” Livers says. “To make sure a terrific buyer expertise and proceed to personal your buyer relationships, it’s essential for manufacturers to transcend the pandemic pivot and make the funding in their very own cell expertise.